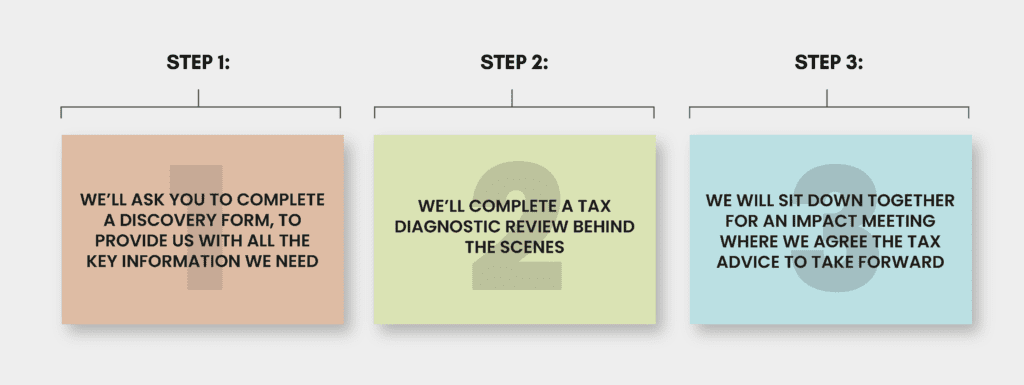

STEP 1: Discovery Stage

We’ll gather the key information required about you and your business, in order to complete Step 2 the Tax Diagnostic Review.

STEP 2: Tax Diagnostic Review

We’ll run a Tax Diagnostic Review on you and your business, and analyse the findings, ready to share the results with you via the 45-min ‘Impact Meeting’.

STEP 3: Impact Meeting

We’ll invite you to a 45-min ‘Impact meeting’ where we will take you through the Tax Diagnostic results. We will explore three priority areas, explaining why it is relevant, the benefits and the tax savings.

You’ll take away an action plan outlining the priority areas to focus on, including estimated tax savings and quotes for the delivery of recommended tax advice.

Take Forward the Advice!

We’ll take forward any immediate any tax advice, and work with you to deliver your action plan.

FEES

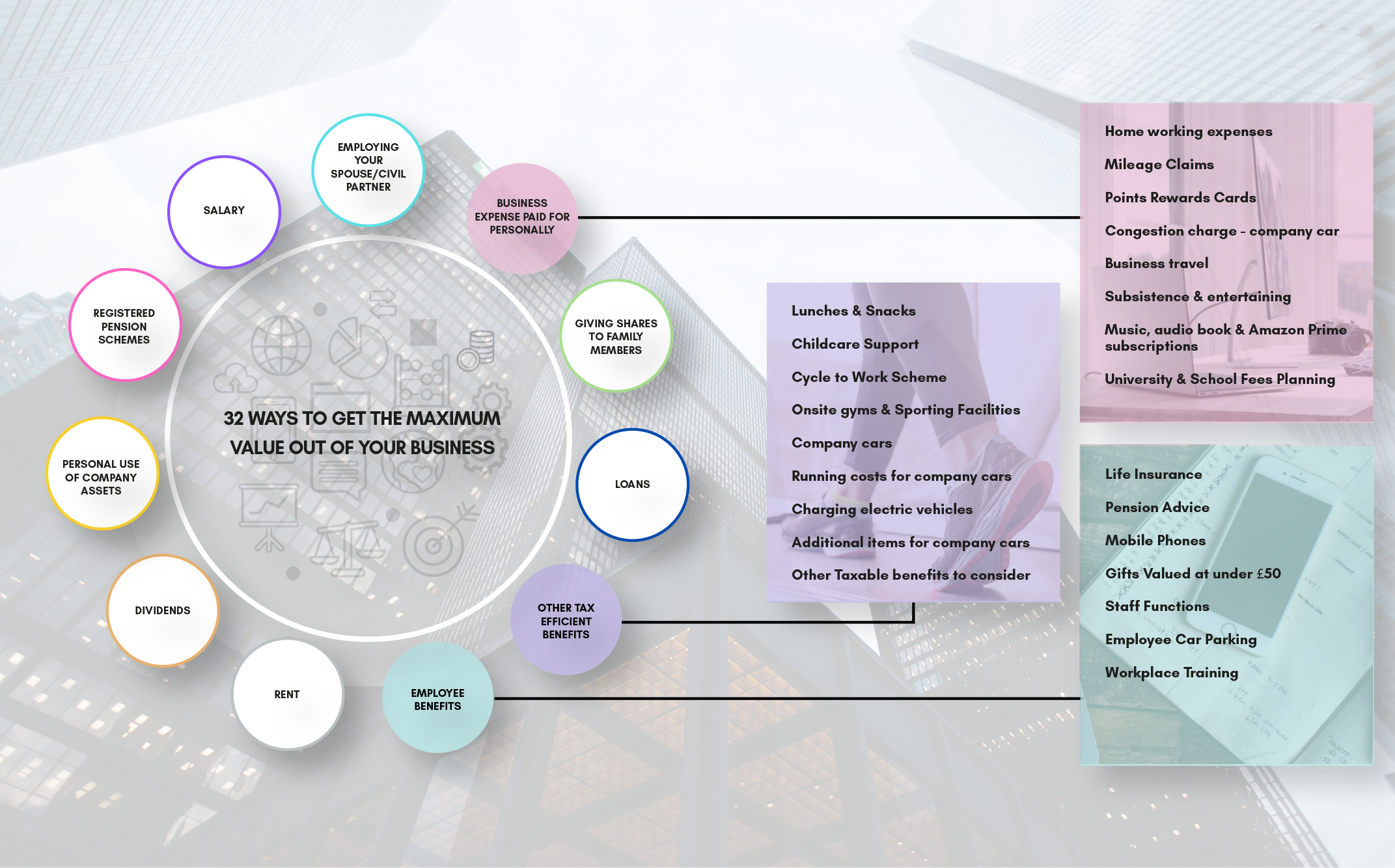

The ‘Extracting Value’ tax diagnostic review is suitable for small stable businesses that are keen to explore the different ways to tax efficiently put things through the business, or take value out of the business to benefit yourself as a business owner.

Extracting Value Tax Diagnostic = £150 -£500

Tax Advice

At the end of your tax diagnostic review, tax advice will be identified to improve your tax position, to make a future saving, or to get cash back into your business.

Where tax advice is identified, we will provide calculated tax savings, a proposal of work and a quote for the delivery.

All tax advice will be quoted for separate from the tax diagnostic review fee.